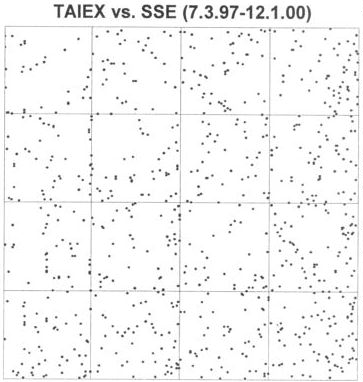

| In his project for the autumn, 2000, fractal geometry

course, Enoch Wu used driven IFS to compare the Taiwan stock market (TAIEX) and the

Shanghai Securities Exchange (SSE). Wu proposed a novel application of IFS: |

| if both markets rise, apply T1(x,y) = (x/2,y/2), |

| if TAIEX falls and SSE rises, apply T2(x,y) = (x/2,y/2) + (1/2,0), |

| if TAIEX rises and SSE falls, apply T3(x,y) = (x/2,y/2) + (0,1/2), and |

| If both markets fall, apply T4(x,y) = (x/2,y/2) + (1/2,1/2). |

|

| That is, in relation to the driven IFS |

|

| If the markets generally move together, we should see many applications

of T1 and T4, thus many points lying along the diagonal from

lower left to upper right. |

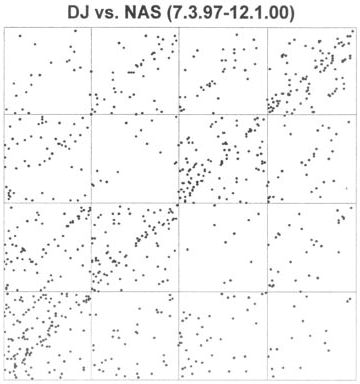

| On the left is the driven IFS for the Dow Jones and

NASDAQ, from July 3, 1997 to December 1, 2000, a total of 861 data points. On the

right, the driven IFS for the TAIEX and the SSE. |

|

| Indeed, we see a strong trend along this diagonal for the DJIA and NASDAQ, not so

strong for the TAIEX and the SSE. |

|